Articles

-

BCIT Awards

Posted on 12 Jan 2024

We would like to congratulate the recipients of the 2023 RGF Integrated Wealth Management Entrance Award and the RGF Integrated Wealth Management Achievement Award

-

Intergenerational Transfer of Wealth Using the First Home Savings Account

By Debbie Saleem on 11 Jan 2024

If you own a home, you may have assumed that the new First Home Savings Account (FHSA) is of no use to you. But have you considered using it as a tool to transfer a portion of your wealth to an adult child or grandchild?

-

Lessons from History – The Legend of Abraham Wald

By Nick Hearne on 11 Jan 2024

Born in Kolozsvar, Hungary (now Romania), in 1902, Abraham Wald’s educational journey began with home-schooling before he pursued geometry at the University of Vienna.

-

Make a Difference with Ocean Wise

By Kaitlyn Harris on 11 Jan 2024

What does the ocean mean to you? For many of us it is a destination, a place to relax and unwind.

-

Important Year-End Tax Filing Information

Posted on 11 Jan 2024

To help you organize for the upcoming tax season, here is some pertinent information regarding estimated tax receipt mailing dates.

-

Financial Challenges in Adversity – A Case Study

By Alain Quennec on 13 Oct 2023

Todd, an engineer, and Margo, a part-time daycare worker, are 54 years old, live in Vancouver, and have two adult children.

-

.jpg?sfvrsn=271ebf48_2)

Generative AI – Fad or Revolution?

By Shaun Sun on 13 Oct 2023

If you’re one of the millions, like myself, who have played around with ChatGPT this year, you were probably blown away by the power of this “generative AI” tool.

-

Tour de Cure 2023

By Brent Vandekerckhove on 13 Oct 2023

The RGF “Market Cycles” once again completed the Tour de Cure, riding 180 kilometres from Chilliwack to Hope. It was a fantastic experience with two days of cycling, camaraderie, and laughter.

-

RGF Integrated Wealth Management James E Rogers Leadership Scholarship Recipient

Posted on 13 Oct 2023

We would like to congratulate the inaugural recipient of the RGF Integrated Wealth Management James E Rogers Leadership Scholarship!

-

What Happens to a TFSA Over-Contribution

By Ryan Gee on 13 Oct 2023

Saving money in your Tax-Free Savings Account (TFSA) is never a bad idea. One of the perks of living in Canada, aside from its beautiful landscape and friendly citizens, is having the ability to set aside after-tax dollars in a TFSA...

-

RGF Integrated Wealth Management James E Rogers Leadership Scholarship

Posted on 04 Jul 2023

-

Benefits of Segregated Funds

By Reg Sangha on 04 Jul 2023

In the world of financial planning, we match the investment product with the purpose and intention for the funds being used.

-

Legacy Planning – a Conversation

By Cecilia Tsang on 04 Jul 2023

This article stems from real conversations I have had with some of my valued clients: “I have been thinking about my legacy. Now that I’ve sold my home, I have been thinking about what to do with the funds."

-

Giving Back to the Community

By Cynthia Boulter on 04 Jul 2023

The Greater Vancouver Food Bank is experiencing unprecedented demand in their 40th anniversary year. Here’s how organizations can provide support at this critical time.

-

First Home Savings Accounts – Available Soon

By Jon Knutson on 04 Jul 2023

Buying a home can be a challenge for many Canadians. Fluctuations in home prices, along with increased interest costs play a huge part in a first-time homebuyer’s ability to afford a home.

-

Winning By Not Losing

By Christian White on 21 Apr 2023

Nostradamus does not work on Wall Street (it would be nice if he did!). The idea that the best investment managers have a crystal ball is not accurate.

-

Why We Do What We Do

By Mark Neufeld on 21 Apr 2023

When I first started working in the financial planning profession, I had no idea what it was all about.

-

Ian MacLeod

By Ian MacLeod on 21 Apr 2023

In The Financialist from January 2023, you asked for “any stories, fond memories, or photos you would like to share,” so here goes...

-

RGF and BCIT Business

By Lester De Guzman on 21 Apr 2023

The BCIT Financial Planning Diploma provides students with industry relevant skills and training to help prepare them to start fulfilling careers.

-

2022 Tax Planning

By Anthony Ma on 21 Apr 2023

Tax filing season is here and is probably at least in the back of your mind.

-

Case Study: Life Insurance in Retirement – Helping Adult Children Equitably

By Tara Ennevor on 12 Jan 2023

How can you help an adult child in need now and ensure any other children are treated equally?

-

Tapping Your Portfolio for Some Quick Cash

By John Hale on 12 Jan 2023

Given the high inflation we have all experienced over the last 12 months, it comes as no surprise that many household budgets are being pushed to their limit.

-

Don’t Be Afraid!

By Mike Duffy on 12 Jan 2023

Fear can literally kill you. Fear is an incredibly destructive force in the human psyche. Fear comes from the Latin word periculum, which means “peril.”

-

Important Year-End Tax Filing Information

Posted on 12 Jan 2023

To help you organize for the upcoming tax season, here is some pertinent information regarding estimated tax receipt mailing dates.

-

Case Study: Retirement Investing for Small Business Owners

By Linson Chen on 07 Oct 2022

You have excess cash that is accumulating in your corporation that you do not need for personal or business purposes.

-

What You Need to Know about Dividends

By Daniel Sitar on 07 Oct 2022

If you own stocks in your investment portfolio – either directly or through mutual funds or exchanged traded funds – you are a part owner in multiple businesses.

-

BBQ Tips from Rusty Johnson

By Rusty Johnson on 07 Oct 2022

I am Rusty Johnson and I’m the Pitmaster/Head Chef of Rusty’s BBQ! I am a competition cook who specializes in live fire cooking.

-

Just Testing Your Shock Absorbers…

By Brett Simpson on 07 Oct 2022

I have spent my entire 39-year career (and counting…) helping people who seek advice on how to plan financially for a future of security and choice.

-

Longevity and Life Annuities

By Clay Gillespie on 28 Jul 2022

A couple of questions we commonly get asked are “What is a life annuity?” and “Should I consider a life annuity in my situation?”

-

The “Market”ing of Economics

By Cory Hill on 28 Jul 2022

In the past, business program pundits, market analysts, and other “market experts” were routinely featured on various television and radio programs, and quoted in print media to share their opinions on investing.

-

Our Changing Gardens

By Brian Minter on 28 Jul 2022

Despite the long, cold, and often challenging spring weather, Canadians across the country are highly engaged in beautifying their homes, both indoors and out.

-

Old Age Security – a Few Considerations

By Bryn Hamilton on 28 Jul 2022

Often when clients are approaching retirement, we get the question, “Should I defer Old Age Security (OAS) or automatically take it at 65?”

-

Case Study: Drawing Down Your RRIF Tax-efficiently

By Reg Sangha on 28 Apr 2022

Many of you of have undoubtedly heard the saying from Benjamin Franklin in 1789, “In this world nothing can be said to be certain, except death and taxes.” He was not the first to utter those words nor will he be the last.

-

The Tale of Two Inflations

By Bryson Milley on 28 Apr 2022

Over the past few months, there has been a growing rumble of conversation about inflation. Most people know what inflation is but understanding the root cause of inflation can be something different.

-

Building Your Great Canadian Bucket List

By Robin Esrock on 28 Apr 2022

Robin Esrock is the bestselling author of The Great Canadian Bucket List. You can follow him at robinesrock.com or visit canadianbucketlist.com

-

Canadian Federal Budget 2022

By Chris Eynon on 28 Apr 2022

On April 7, the Liberal government published the new Canadian Budget. Some of the items were expected and some expected anticipated items were not included.

-

Case Study: Solving the Retirement Income Puzzle

By Anne Hammond on 07 Jan 2022

“Retirement” – the word represents many things these days. It could be a lifestyle full of travel and adventures, or perhaps a transition to volunteer work...

-

Pension Considerations – One of the Biggest Decisions of Your Life

By Teresa Black Hughes on 07 Jan 2022

Called the Great Resignation, since the pandemic, employees are leaving the workplace/workforce or switching jobs in droves.

-

The Joy of Decluttering: A Professional Organizer’s Practical Guide

By Quincilia Siah on 07 Jan 2022

Clutter is everywhere. If we can get it under control, we can create a lot of harmony in our lives.

-

Important Year-End Tax Filing Information

Posted on 07 Jan 2022

To help you organize for the upcoming tax season, here is some pertinent information regarding estimated tax receipt mailing dates.

-

Behavioural Finance

By Brent Vandekerckhove on 06 Oct 2021

The investment world is based on decisions humans make regarding money every day – some decisions lead to positive outcomes, and others have negative results.

-

The Impact of Foreign Exchange Rates on Investment Returns

By Nick Hearne on 06 Oct 2021

When we think about the value of the Canadian dollar (CAD) in relation to other currencies, our first thought is often our buying power when we travel abroad.

-

Namaste Canada: A Culinary Journey from India to Canada

By Vikram Vij on 06 Oct 2021

I love to share memories of my journey and the recipes that I’ve learned along the way.

-

Personal Finance 101

By Shaun Sun on 06 Oct 2021

I hope settling into a back-to-school “routine” has been going well for parents and students everywhere

-

Property Tax Deferment

By Jon Knutson on 26 Jul 2021

While Canadian real estate prices have soared, so has the cost of maintaining a home. Fortunately, there is a government program to help defer one of the costs associated with home ownership.

-

What Is a “Return”?

By Alain Quennec on 26 Jul 2021

There’s an old investment joke that goes, “Do investors care more about the return on their investment or the return of their investment?” We want growth plus our original investment back to us, don’t we?

-

Today’s Executor is a Digital Executor

By Sharon Hartung on 23 Jul 2021

On May 13, 2021, I was delighted to join RGF advisors and clients for their second virtual event where I discussed the ideas covered in my first book, Your Digital Undertaker– Exploring Death in the Digital Age in Canada.

-

Stuck In a Box?

By Cecilia Tsang on 23 Jul 2021

Our conscious mind likes to create “boxes” that we use to organize the world around us. These boxes are often created through our upbringing and the influence of our parents, peers, society, and the media.

-

Planning for Retirement... Mentally

By Debbie Saleem on 29 Apr 2021

You’ve met with your advisor and are delighted to find out that you’re financially on track to retire within the new few years.

-

Can You Tilt the Odds in Your Favour?

By Christian White on 29 Apr 2021

It can be difficult not to jump into these high-flying stocks that we see day to day in the media.

-

Growing Plants in Containers

By Brian Minter on 29 Apr 2021

Container gardening has grown exponentially, especially now with today’s new realities of smaller-space gardens and patio lifestyles.

-

Can You Hear Me Now?

By Mark Neufeld on 29 Apr 2021

As I reflect on the past 12 months since this global pandemic was officially declared, there is one phrase (other than pivot), I think we’ve all heard many times…

-

Oh, What a Year!

By Tara Ennevor on 07 Jan 2021

As we look back at 2020, many would like to erase it from the books and start over! This is occasionally the sentiment at the start of a new year, but even more so now.

-

Estate Planning in the Digital Age

By Anthony Ma on 07 Jan 2021

The arrival of COVID-19 vaccines is providing a sense of hope for the eventual end to the global pandemic.

-

.jpg?sfvrsn=c3ba1ca4_0)

When Should You Start Receiving Your CPP Retirement Pension?

By Doug Runchey on 07 Jan 2021

Since 1987, when the Canada Pension Plan (CPP) first introduced flexible retirement pension start dates, this has been one of the most common questions that I get asked...

-

It’s not about a rate of return

By Daniel Sitar on 26 Nov 2020

As the saying goes, money cannot buy happiness. However, having confidence in your financial decisions and your ability to reach your long-term objectives results in security and peace of mind

-

.jpg?sfvrsn=271ebf48_2)

Creativity Has Its Consequences

By Bryn Hamilton on 23 Oct 2020

Financial engineering is the term used to describe an institution’s innovation in security design.

-

Opportunities Where You Least Expect Them

By Brett Simpson on 22 Oct 2020

When we are young, we don’t know what we don’t know!

-

Retirement on Your Horizon? Considerations of the Pandemic ’s Ripple Effects

By Isabelle St-Jean on 21 Oct 2020

While leading retirement seminars for pre-retiring professionals over the past 10 years, I have observed diverse levels of readiness, attitude, and concern toward this major work/life transition.

-

Financial Tips for Young Adults

By John Hale on 20 Oct 2020

Recently, my nephew and I went out for lunch to celebrate his acceptance to the University of Victoria. I would like to share some of the financial advice I passed on to him.

-

Navigating Stormy Seas

By Daniel Sitar on 13 Jul 2020

My father has been a passionate sailor for most of his life. In his twenties, he sailed from Victoria to Maui and in recent years, he has competed in several long-distance races.

-

What is the Value of a Financial Advisor?

By Linson Chen on 13 Jul 2020

While investing is an important aspect of the job, good financial advisors will distinguish themselves through the advice and the service aspect of the relationship.

-

The State of Mortgage Financing during Covid-19

By Tyler Wilson on 10 Jul 2020

While there have been many changes to our world over the last three months, one of the relatively surprising consistencies has been mortgage qualification.

-

Income Volatility in Retirement

By Cory Hill on 10 Jul 2020

As investors, we have all seen what effect market volatility has on the value of one’s portfolio.

-

The Ins and Outs of Estate Planning

By Clay Gillespie on 23 Apr 2020

Estate planning is the process of arranging one’s affairs while minimizing administrative burdens, costs, and income tax upon death.

-

Reflecting on a Life Lived

By Teresa Black Hughes on 23 Apr 2020

One of my favourite magazines is the long-standing Reader's Digest, because they share great stories about people and their lives.

-

Flashbacks to Another Time

By PMB and JAB on 22 Apr 2020

When my wife and I met with our advisor, Bryson, our chat turned to his recent Yukon trip, which caused flashbacks to our time in Atlin, BC.

-

Canada’s COVID-19 Economic Response Plan

By Chris Eynon on 22 Apr 2020

The Canadian federal government has taken unprecedented action to address the financial impacts of COVID-19.

-

The Wonder of Change… Creating Space for the New

By Vera Vlaovich on 20 Jan 2020

One of life’s most exciting and scary things is change. With 2020 upon us, many of us are making resolutions, creating vision boards, and writing down our goals for the coming year. These all require an openness to change.

-

What is a Financial Plan?

By Anne Hammond on 20 Jan 2020

What does it mean to create a financial plan? And why is it important to do so?

-

Helping Charities Thrive Through Mythbusting

By Andrew Stegemann on 20 Jan 2020

How can we do the most for the causes we love? It starts by changing some common misconceptions. There are myths we’ve been taught to believe about the charitable sector that are actually undermining the causes we love.

-

Important Year-End Tax Filing Information

Posted on 20 Jan 2020

To help you organize for the upcoming tax season, here is some pertinent information regarding estimated tax receipt mailing dates.

-

RESPs – The Other Side of the Process

By Bryson Milley on 24 Oct 2019

The school year is now officially well in motion, and for those with children in grade 12, I’m sure there are regular conversations about post-secondary schooling…where to go, what classes to take, etc..

-

Critical Illness Insurance

By Brent Vandekerckhove on 24 Oct 2019

Managing risk is something we do in many aspects of our lives. When I give seminars on financial planning, I like to ask the audience what they think their biggest asset is. Most will answer their home, especially in the Lower Mainl

-

Travel Tips to Consider Before Your Next Trip

By Claire Newell on 24 Oct 2019

Knowing the tricks of the travel trade could save you money and hassle the next time you take a trip. There are plenty, but here are a few of my favorites to consider before your next trip.

-

Making an Election for your Defined Benefit (DB) Pension

By Nick Hearne on 24 Oct 2019

Employers guarantee a specific retirement benefit for each employee who participates in their defined benefit pension plan.

-

We have Hope…

By Mark Neufeld on 24 Oct 2019

On Saturday, August 24th and Sunday, August 25th, the Market Cycles of RGF Integrated Wealth Management took part in their 11th straight Ride to Conquer Cancer benefiting the BC Cancer Foundation.

-

Advisors, Pilots, Sailors – We’re All the Same

By Alain Quennec on 22 Jul 2019

All three professionals help people navigate a journey to their desired destination.

-

Welcome Announcement

Posted on 22 Jul 2019

We at RGF Integrated Wealth Management are pleased to welcome Brent Vandekerckhove and his assistant, Kayla Schmiler, as the new members of our firm.

-

Happy 10th Birthday, TFSA!

By Cecilia Tsang on 22 Jul 2019

The Tax-Free Savings Account (TFSA) is 10 years old this year. The TFSA has been a very powerful tool in tax planning and optimization planning (such as ensuring OAS clawback is minimized) in the ten years since it began.

-

How to Cultivate Gratitude in Kids

By Dr. Deborah MacNamara on 21 Jul 2019

We can give our children a lot – from material possessions, to our time and energy. In return, we often desire or expect expressions of gratitude from them, but this doesn’t always happen.

-

How Deep Does Your Diversification Go?

By Shaun Sun on 20 Jul 2019

One of the goals of a well-constructed portfolio is to reduce the overall risk witout sacrificing return. This is partly achieved through diversification, a concept many people understand as ‘not putting all your eggs into one basket’.

-

Do Your Biases Affect Your Results?

By Christian White on 05 Apr 2019

Biases can both help and hinder. However, too much of any one thing can have a negative effect on your portfolio’s return.

-

The Case for Active Management with your Fixed Income

By Jon Knutson on 05 Apr 2019

As financial advisors, we make investment recommendations for your portfolio that are based on many factors, including your risk tolerance, investment objectives and your time horizon.

-

Reach Your Retirement Goals More Quickly with an IPP

By Spenser McCaig on 05 Apr 2019

Scientists anticipate that the first person who will live to 200 has already been born.

-

Retirement Reflections

By Mark Neufeld on 05 Apr 2019

I’ve had the privilege and honor to work with many clients transitioning to retirement over my nearly 20-year career in financial services.

-

Your Love Letter: New Year’s Resolution

Posted on 24 Jan 2019

Love isn’t in the big gestures. It’s in the small details – the everyday minutiae of the lives of people that we care for.

-

Choosing an Investment Fund

By Bryn Hamilton on 24 Jan 2019

For the purposes of this piece, we will be focusing on managed money and, in particular, mutual funds. An investment advisor who chooses investment funds on behalf of a client is implementing what’s called Overlay Money Management.&nbs

-

The Collaborative Process

By Lisa Alexander on 24 Jan 2019

My initial conversation with the client had been friendly, but brief. He gave me most of the relevant details unprompted and had obviously done some research on what might be expected during the divorce process.

-

Important Year-End Tax Filing Information

Posted on 23 Jan 2019

To help you organize for the upcoming tax season, here is some pertinent information regarding estimated tax receipt mailing dates.

-

How Small Things Can Make a Big Difference

By Brett Simpson on 22 Oct 2018

After thirty-five years of financial advising, I would like to share some insights I’ve recognized as important ingredients in effective integrated wealth management.

-

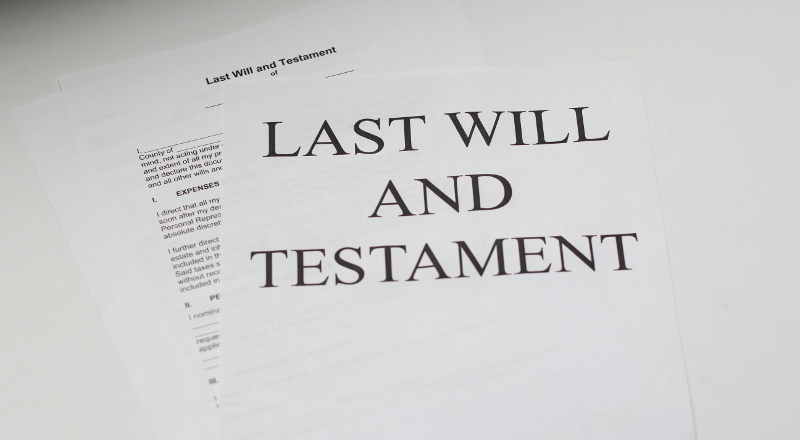

Do You Have a Will?

By John Hale on 21 Oct 2018

Is that will of yours looking a little worn and tattered or perhaps you don’t have a will at all?If the answer is yes, you are not alone.

-

Making the Best Use of Your Home Equity in Retirement

By Rick Orford on 20 Oct 2018

In the past 10+ years, Vancouver homeowners have enjoyed significant increases in property values. In some cases, property values have increased 2x and 3x

-

Ten years and counting…

By Mark Neufeld on 19 Oct 2018

On Saturday August 25th and Sunday August 26th, the Market Cycles of RGF Integrated Wealth Management took part in their 10th straight Ride to Conquer Cancer benefiting the BC Cancer Foundation.

-

The Big Six Bias

By Cory Hill on 09 Jul 2018

Today, many of us have fragmented relationships with our financial institutions. Gone are the days when we would head to our local bank branch to take care of our monthly bills, deposits,withdrawals and update our bank books,

-

Responsible Investing Myths

By Linson Chen on 08 Jul 2018

According to the 2017 Responsible Investment Association (RIA) Investor Opinion Survey, a majority (77%) of Canadian investors are interested in responsible investing (RI) yet they know little or nothing about it.

-

Wills Variation Estate Primer

By Erin Hatch on 07 Jul 2018

As you make decisions regarding your estate and succession planning, you want to ensure that your final wishes will be upheld and withstand judicial scrutiny.

-

Why TFSA’s Are Important, Especially for Pensioners

Posted on 06 Jul 2018

Let’s look at a quick scenario we typically come across as financial planners working with pensioners. You are about 5 years away from retirement.

-

Undue Influence – Avoid an Undoing

By Teresa Black Hughes on 27 Apr 2018

I had a pastor many years ago who often said, “If it weren't for people…”.

-

What does Life Expectancy Actually Mean?

By Clay Gillespie on 27 Apr 2018

Life expectancy is one of the most misunderstood aspects of retirement income planning - yet, it is one of the most important factors.

-

What to Look for When You Buy Home Insurance

By Kevin McLean on 27 Apr 2018

‘Water is the new fire’ says the Insurance Bureau of Canada (IBC)

-

BC Budget 2018

By Chris Eynon on 26 Apr 2018

BC Finance Minister Carole James has released the NDP’s first full budget. The Finance Minister said that the intent is to “include historic investments in child care and affordable housing that will be felt for generations”.

-

Our New Name

Posted on 26 Jan 2018

We have changed our name to RGF Integrated Wealth Management.

-

A Year in Review

By Cory Hill on 26 Jan 2018

At this time of year, we are all accustomed to looking back at the year that has gone by. Today, I would like to suggest that we look ahead to 2018.

-

The power of a Power of Attorney

By Anne Hammond on 26 Jan 2018

“Isn't it nice to think that tomorrow is a new day with no mistakes in it yet?"

-

Looking for graduation Ideas this Spring? Why not give the Gift of a Financial Plan?

By Vera Vlaovich on 26 Jan 2018

With spring just around the corner, parents may be wondering what memorable gift may be appropriate for their graduating daughter and/or son.

-

Thank you for partnering with us...

By Mark Neufeld on 02 Oct 2017

On Saturday, August 26th and 27th, our RGF team, the Market Cycles took part in the 2017 Ride to Conquer Cancer – our ninth in as many years.

-

Sharing is Caring

Posted on 02 Oct 2017

Do you ever find that you can rationalize putting off important responsibilities because they may be painful or cause discomfort?

-

Maintaining your Retirement Capital

By Daniel Sitar on 02 Oct 2017

Everyone has different goals and expectations for their retirement. Likewise, everyone has a different level of financial resources they can use to achieve these goals.

-

Financial Advisor – Part Advisor, Part Counsellor, Part Coach

By Bryson Milley on 01 Oct 2017

When I first started in this profession, I thought I had a good idea of what it meant to be a financial advisor. An advisor had to develop a strong understanding of the investment world, become reasonably well-versed in the tax rules..

-

Q and A: What is an annuity and how does it work?

Posted on 03 Jul 2017

A life annuity is a financial vehicle that allows you to exchange a lump sum of capital for a guaranteed income for as long as you live (or you and your spouse or partner lives).

-

Q and A: How long can I contribute to an RESP? And how long can I collect the CESG on behalf of my child?

Posted on 03 Jul 2017

Generally speaking, you can contribute to a family plan as long as the beneficiaries are less than 31 years of age at the time of contribution.

-

The Importance of Budgeting

By Nick Hearne on 03 Jul 2017

A strong awareness and understanding of your personal finances is an integral part of the financial planning process. This holds true regardless of your phase in the financial life cycle.

-

Pools and Streams – Retirement Income

By Alain Quennec on 03 Jul 2017

Louise is retiring soon, and it just dawned on her that she isn’t clear what’s going to happen to her cash flow after the regular paycheques stop coming in. I find this a great source of concern among the nearly-retired...

-

The Right Kind of Mortgage Protection

By Shaun Sun on 03 Jul 2017

If you’ve had to obtain a mortgage to purchase a home or condo, you will have noticed the number of times insurance was discussed.

-

Identity Theft Online

By Cecilia Tsang on 03 Jul 2017

Just last week, a good friend of mine told me that his bank account had been compromised. He received several PayPal withdrawals that he didn’t authorize and thousands of his funds were gone.

-

The Goose and the Basket of Golden Eggs

By Brett Simpson on 18 Jun 2017

If you had a goose that laid golden eggs, which is worth more: the eggs already in your basket or those yet to come? What value do you put on the goose?

-

Q and A: My wife recently died and I am not clear on how this will change my government benefits or my income tax situation.

Posted on 03 Apr 2017

Answer: One of the major implications for you will be that you will no longer be able to split pension or RRIF (Registered Retirement Income Fund) income on your income tax returns.

-

Q and A: Can I have more than one Tax Free Savings Account? With different institutions?

Posted on 03 Apr 2017

Yes, you can have more than one Tax Free Savings Account (TFSA), with different institutions.

-

2017 Federal Budget – Thoughts

Posted on 03 Apr 2017

The Federal Budget was delivered in Parliament on March 22, 2017. From a tax perspective, it could be referred to as “The Budget That Wasn’t”.

-

Keeping More of what you Earn

By Christian White on 03 Apr 2017

You’ve saved long and hard for many years. You’ve made sacrifices and put your long-term needs ahead of your current desires for that vacation, the newer car or upgrading the kitchen.

-

Shopping for a New Car – To Lease or To Buy?

Posted on 03 Apr 2017

You’ve made the decision to purchase a new vehicle, and now you must ask yourself – should I lease or should I buy? This is a question that we come across time and again with our clients.

-

Debt Management and Mortgage Services

By Mark Neufeld on 03 Apr 2017

If you are seeking a new mortgage, or have a mortgage that is coming up for renewal soon, then this article is for you.

-

A New ‘New Year’s Resolution’ – Talking to your Kids about Money

Posted on 02 Jan 2017

A New Year is underway and some of us have already broken our New Year’s resolutions…

-

Investing Your Tax Refund: Failing to Reinvest your Refund undermines an RRSP’s efficiency

By Bryn Hamilton on 02 Jan 2017

The idea of a tax deduction against your taxable income and the refund it generates is a very attractive idea to many. That vacation we had been thinking about all year is finally afford- able knowing we have that nice chunk of money c

-

Do Corporate Class Mutual Funds Still Make Sense?

By Jon Knutson on 02 Jan 2017

Canadian mutual funds can take the legal form of a trust or corporation. While most funds are structured as mutual fund trusts, some are structured as mutual fund corporations. The latter are also known as corporate class funds.

-

Disability Insurance for Business Owners

Posted on 02 Jan 2017

If your business depends on your ability to actively generate income, your absence due to disability can have a significant impact on your financial well-being.

-

A Recap of our Annual Ride to Conquer Cancer

By Mark Neufeld on 03 Oct 2016

On Saturday August 27th and 28th our team, the Market Cycles, of Rogers Group Financial took part in the 2016 Ride to Conquer Cancer – our eighth in as many years.

-

Giving Back to Make a Difference

Posted on 03 Oct 2016

I have been actively involved with charitable organizations for the past 19 years, but I have been charitably-minded my whole life.

-

Preferred Shares

By John Hale on 03 Oct 2016

It's no secret that today's low interest rate environment poses a real challenge for Canadian.

-

What's Right When Things Go Wrong?

By Brett Simpson on 03 Oct 2016

There are some risks that we take purely for the fun of it: skinny-dipping, roller coasters, even alcohol consumption. These risks range from fairly benign to potentially catastrophic.

-

Beneficiary Designations – benefits and considerations

By Nick Hearne on 09 Sep 2016

Individuals have the option to designate beneficiaries directly on assets such as registered plans, insurance policies and annuities.

-

Q and A: How do I take advantage of the Government of Canada online tools and resources?

Posted on 01 Jul 2016

A good place to start would be to register to access your information with the Canada Revenue Agency (CRA) online.

-

Q and A: How can I find out how much I have contributed to the RESP of each of my children and how much of the CESG they have received?

Posted on 01 Jul 2016

To get this information, you, as the subscriber for the RESPs, will need to call the Canada Education Savings Program (CESP) toll-free line at 1-888-276-3624, between the hours of 8am and 5pm (ET), Monday to Friday.

-

The Loonie

By Chris Eynon on 01 Jul 2016

In 1987, the Royal Canadian Mint produced a small, gold-colored coin (actually, it is currently made of steel with brass plating) to replace our paper one dollar bill.

-

2016 Horizons Report

By Clay Gillespie on 01 Jul 2016

We are pleased to present the results of the 2016 Horizons Retirement Report. This report summarizes the dreams, fears, hopes and challenges of Canadians planning to retire within the next 3 to 7 years.

-

How I plan to Accumulate $100,000 for my Child's Post-Secondary Education

By Linson Chen on 01 Jul 2016

My wife and I are expecting our first child this August. As new parents to be, we are spending a lot of time analyzing our finances and are doing a lot of planning to ensure that we are well prepared.

-

Q and A: Should I purchase mortgage insurance through my lender?

Posted on 01 Apr 2016

If you are looking to purchase a home, you should discuss your options with your Rogers Group Financial advisor.

-

BC Provincial Budget 2016

By Anne Hammond on 01 Apr 2016

On February 16th, the BC government did the first reading of its 2016 provincial budget. As always, there is both good and bad news for BC residents, depending on their personal situations. Here are some of the highlights.

-

Your E-legacy

By Teresa Black Hughes on 01 Apr 2016

Almost forty years ago in 1977, personal computers made their entrance into our lives as “microcomputers” and in 1980, as “home computers” intended for the non-technical user.

-

RRSPs – Taking Money Out Before Retirement

Posted on 01 Apr 2016

A Registered Retirement Savings Plan (RRSP) is a financial planning tool which is widely used by Canadians. A common assumption is that the funds in this account should not be touched until that glorious era of your life – retirement.

-

Building your Financial Future

By Bryson Milley on 01 Apr 2016

One of the most regular questions I’m asked by retiring clients is, “How do we manage our investments once we’re retired?”

-

Financial Literacy: Talking to our Children about Money

By Vera Vlaovich on 01 Jan 2016

Teaching our children about money and how to handle it can oftentimes be a difficult topic for many parents.

-

Passive Investing…These Aren’t Your Parents’ Index Funds Anymore!

By Cory Hill on 01 Jan 2016

By definition, passive investing is best described as an investment strategy that tracks a market-weighted index or portfolio.

-

Human Capital and the Financial Life Cycle

Posted on 01 Jan 2016

Take a moment to think back to the day you got your first job. At that time, you likely had minimal financial assets and no real estate...

-

An Unforgettable Ride to Conquer Cancer...

By Mark Neufeld on 01 Oct 2015

On August 29th and 30th, our team, the Market Cycles, took part in the 7th annual Ride to Conquer Cancer. A total of 2,087 riders helped raise $8.4 million for the BC Cancer Foundation.

-

Quantifying the Value of Advice

By Alain Quennec on 01 Oct 2015

Earlier this year, the investment firm Vanguard released the results of a major study attempting to quantify the value of financial advice to investors.

-

Hope for the Best, Plan for the Worst

By Cecilia Tsang on 01 Oct 2015

Ann and Will loved to socialize. Every Friday night, 52 weeks a year, their many friends went to their home to gather for coffee and appies.

-

2015 Horizons Retirement Report

By Clay Gillespie on 18 Jul 2015

Many of our clients are concerned about what life will look like during their retirement years. For this reason, we started our retirement survey five years ago to explore what Canadians are thinking as they approach retirement.

-

Losing your Group Health Coverage?

By Jon Knutson on 01 Jul 2015

As Canadians, we have one of the best healthcare systems in the world—but that doesn’t mean your provincial government provides you with all the healthcare coverage you need.

-

What is a Carrying Broker?

Posted on 01 Jul 2015

If you hold securities with Rogers Group Investment Advisors, you will have received a notice detailing the change to our new Carrying Broker.

-

The Miracle of Life Insurance

Posted on 01 Apr 2015

People may not want life insurance, but they do want what life insurance can provide.

-

The Registered Disability Savings Plan (RDSP)

By John Hale on 01 Apr 2015

A question faced by loved ones who care for family members that suffer from disabilities is, “How will I protect them once I am gone?”

-

Benefits for Families in British Columbia

By Chris Eynon on 01 Apr 2015

The federal government announced a new tax credit that they are referring to as the Family Tax Cut.

-

Case Study: In-Kind Donations to Charities

By Linson Chen on 01 Feb 2015

Cash gifts are the most common way to donate to a charity. It’s a simple way to give and it provides you with a tax credit, but it may not be the most tax-efficient way to donate.

-

Case Study: The Case of the Missing Deduction

By Teresa Black Hughes on 04 Jan 2015

The tax return is the traffic circle where assets, income, and life come together. The trouble is that February through April are hectic times for tax preparers and tax payors, and little time may be taken to review...

-

Case Study: The Costs of Health

By Shaun Sun on 03 Jan 2015

Don and Jane Smith are the proud and loving parents of 2 children age 15 and 16. At a meeting with their accountant, one of the topics of concern for the family is the large health costs...

-

Case Study: Alter Ego Trusts

By Mark Neufeld on 02 Jan 2015

Many of my clients are single and/or widowed. I recently was working with one of my long-term clients in regard to her estate plan. She is a widow and holds significant non-registered investments of roughly $2,600,000.

-

How Things Change, But Line Items Look the Same

By Bryson Milley on 01 Jan 2015

Over the past 30 to 40 years, investment management styles and techniques have changed quite a bit.

-

Your RRSP Roadmap

Posted on 01 Jan 2015

With the RRSP deadline fast approaching (the deadline for the 2014 tax year is March 2nd, 2015), I wanted to take this opportunity to provide some insight on the rules of the road for RRSPs.

-

Financial Planning for Small Business Owners

Posted on 01 Jan 2015

On the training day for my first job as a dishwasher, I was told to imagine I was a business owner. “The better your business washes dishes,” I was told, “the more money your business will make.”

-

Case Study: RESP – Family Plans: Using In-Kind Contributions

By John Hale on 31 Dec 2014

An RESP combines flexibility, tax-deferred investment growth and direct government assistance to help you reach your education savings goals for your children or grandchildren.

-

Case Study: Registered Disability Savings Plan

By John Hale on 30 Dec 2014

Recently, one of my clients explained that their adult son had suffered from mental illness since he was a late teen and they wanted my advice on how they could help him secure his financial future.

-

Case Study: Guaranteed Income for Life

Posted on 28 Dec 2014

I’d like to introduce you to Jane. Jane is very aware that two of her children could really use a little extra boost financially and she wants to ensure that, upon her death, they will receive as much as possible.

-

Philanthropy through Donor Advised Funds

By Linson Chen on 01 Oct 2014

Philanthropy often conjures up images of people with vast wealth and power; names such as Andrew Carnegie, John Rockefeller and Bill Gates often come to mind.

-

Your Estate Planning, Taking a Second Look

By Anne Hammond on 01 Oct 2014

On February 16th, the BC government did the first reading of its 2016 provincial budget. As always, there is both good and bad news for BC residents, depending on their personal situations. Here are some of the highlights.

-

Why a Corporate Executor can make Sense

By Teresa Black Hughes on 01 Oct 2014

The role of an executor is an important job and a serious responsibility. The executor must manage and dispose of estate assets, file tax returns, and tend to a variety of other tasks to wrap up the deceased’s affairs.

-

Q and A: Where can I find info about deposit insurance on GICs?

Posted on 01 Jul 2014

There are a few different institutions that provide deposit insurance, depending on the type of deposit you have.

-

Divorce and the Gift of Gratitude

By Vera Vlaovich on 01 Jul 2014

Over five years ago, my now ex-husband and I agreed to separate. At the onset of this decision, it all seemed seamless and easy, but we were two people coming from different places at different stages in our lives.

-

Retirement Income Planning

Posted on 01 Jul 2014

During your working life, you may have had one or two sources of income with limited ability to manage the timing of cash flows.

-

Building an Efficient and Effective Emergency Fund

By Shaun Sun on 01 Jul 2014

One of the fables I remember repeated numerous times during grade school was Aesop’s tale of the ant and the grasshopper.

-

Horizons Retirement Report 2014

By Clay Gillespie on 01 Jul 2014

Every year, we commission a survey (conducted by Concerto Research) to explore what Canadians are thinking and feeling as they approach retirement.

-

Q and A: Can you explain BC-specific children RESP grants?

Posted on 01 Apr 2014

Yes, the BC Training and Education Savings Grant was introduced this year. It is meant to help families start planning and saving early for education beyond high school.

-

Going Viral

By Cory Hill on 01 Apr 2014

Recently, there was a study done by Princeton’s Department of Mechanical and Aerospace Engineering on, of all things, the life cycles of social media.

-

Beyond the RRSP

By Mark Neufeld on 01 Apr 2014

When you require income from your RRSP, a Registered Retirement Income Fund (RRIF) may be appropriate for you.

-

Global Investing and the Winter Olympics

Posted on 01 Apr 2014

Like most Canadians, I spent many hours in front of the television this February, eyes glued to the spectacular Olympic Games.

-

Aligning your Goals

By Cecilia Tsang on 01 Apr 2014

Is your portfolio the result of your goals (or lack thereof)?

-

Securing Your Children's Future

By Chris Eynon on 01 Jan 2014

My wife and I had a baby boy on August 5, 2011. He just turned two and shares his birthday with his grandmother Ann. Liam is my first child and my wife Rita’s second.

-

Protect Yourself

Posted on 01 Jan 2014

If an investment you're interested in has the characteristics of one of the five warning signs below—it’s okay to say ‘no’.

-

Tax Savings and RRSPs

By John Hale on 01 Jan 2014

Many of our clients use Registered Retirement Savings Plans (RRSPs) as one of the pillars of their wealth building strategy. An RRSP is a type of retirement savings plan that is registered with the Canada Revenue Agency.

-

Tax-advantaged Health Spending

By Jon Knutson on 01 Jan 2014

If you own a small business and are tired of paying medical and dental bills for you and your family with personal after-tax dollars, you should investigate a little-known section of the Income Tax Act.

-

ETF or Mutual Fund, What's the Difference?

By Alain Quennec on 01 Jan 2014

Most investors leave the choice of selection of individual stocks and bonds to a dedicated professional team whose full-time efforts are dedicated to that task.

-

An Emotional Journey to Seattle

By Mark Neufeld on 01 Oct 2013

On June 15th and 16th, our team, the Market Cycles, (twelve individuals from the firm and twelve friends of the firm) took part in the 5th annual ride to Conquer Cancer

-

The One Thing

By Brett Simpson on 01 Oct 2013

In the 1991 movie “City Slickers”, Curly (Jack Palance) asks Mitch (Billy Crystal): “Do you know what the secret to life is?”

-

Don't Outlive Your Capital

Posted on 01 Oct 2013

The oldest “official” living person in the world is now 115 years old, although there was a recent unofficial report of a 127- year- old lady in China.

-

Death and Taxes: Are They Really a Sure Thing?

Posted on 01 Jul 2013

Have you ever thought of the concept of immortality?

-

The Complications of Marriage Break-ups, What we Can/Cannot Do

By Bryson Milley on 01 Jul 2013

In our profession, we have the privilege of getting to know clients really well over many years

-

Horizons Retirement Report 2013

By Clay Gillespie on 01 Jul 2013

We’ve just completed the 2013 edition of the Horizons Retirement Report. This survey is done with Canadians who are approaching retirement.

-

An Estate Planning Review

By Anne Hammond on 01 Apr 2013

Now that RRSP season is over and many of you have filed your income tax returns, it’s a good time to take a step back and review your estate plan.

-

Personal Corporations and Retirement Income Planning

Posted on 01 Apr 2013

Many of our clients who operate a small business or professional practice in law, medicine, real estate, or accounting will be incorporated.

-

Women Provide Investment Lessons

By Teresa Black Hughes on 01 Apr 2013

Women are often personally connected to the object and process of learning. Their sense of identity, self-esteem, social world and power affect how they learn.

-

TFSA Changes

Posted on 01 Jan 2013

Tax free savings accounts (TFSAs) were originally introduced by the Canada Revenue Agency (CRA) to allow Canadians over 18 to accumulate savings in a tax-sheltered vehicle throughout their lifetimes.

-

Saving for Retirement

By Vera Vlaovich on 01 Jan 2013

RRSPs were introduced in 1957 by the federal government to encourage Canadians to save for retirement.

-

Charitable Giving Strategies

By Mark Neufeld on 01 Jan 2013

Giving to charity is a strong tradition in Canada. Canadian tax filers reported making charitable donations of just under $8.3 billion in 2010, up 6.5% from 2009.

-

It's our Anniversary!

Posted on 01 Jan 2013

Rogers Group Financial was founded in 1973 by Jim Rogers, so we are about to celebrate our 40th year in business!

-

RGF Mourns the Loss of Ken Hawley

Posted on 02 Jul 2010

After a nearly 2-year battle with cancer, Ken Hawley, the Chairman of RGF Integrated Wealth Management (formerly Rogers Group Financial) a 40-year veteran of the financial advisory business, passed away on Monday, May 17th, at the age

Stay Informed

Join our mailing list to receive future updates of new content on our site.

Schedule a Call

To schedule a no obligation introductory call with us, please complete this short set of questions so that we can get in touch with you.

Select a

Date & Time

Please select a desired date and time within the next 30 days for the introductory call.

Selected Date:

Please select a date from the calendar.

Select a Time:

Please select a date from the calendar.

Please select a date and time.How may

we reach you?

Please provide a brief description of how we can help you.

Selected Date: Not Available Time: N/A

Thank you for contacting

RGF Integrated Wealth Management.

We will be calling you at .

You will receive an email confirming the details of your upcoming meeting.

Close Window